Cold Chain Report 23: Energy Tech Will Have Greatest Influence On UK Cold Chain’s Next 10 Years

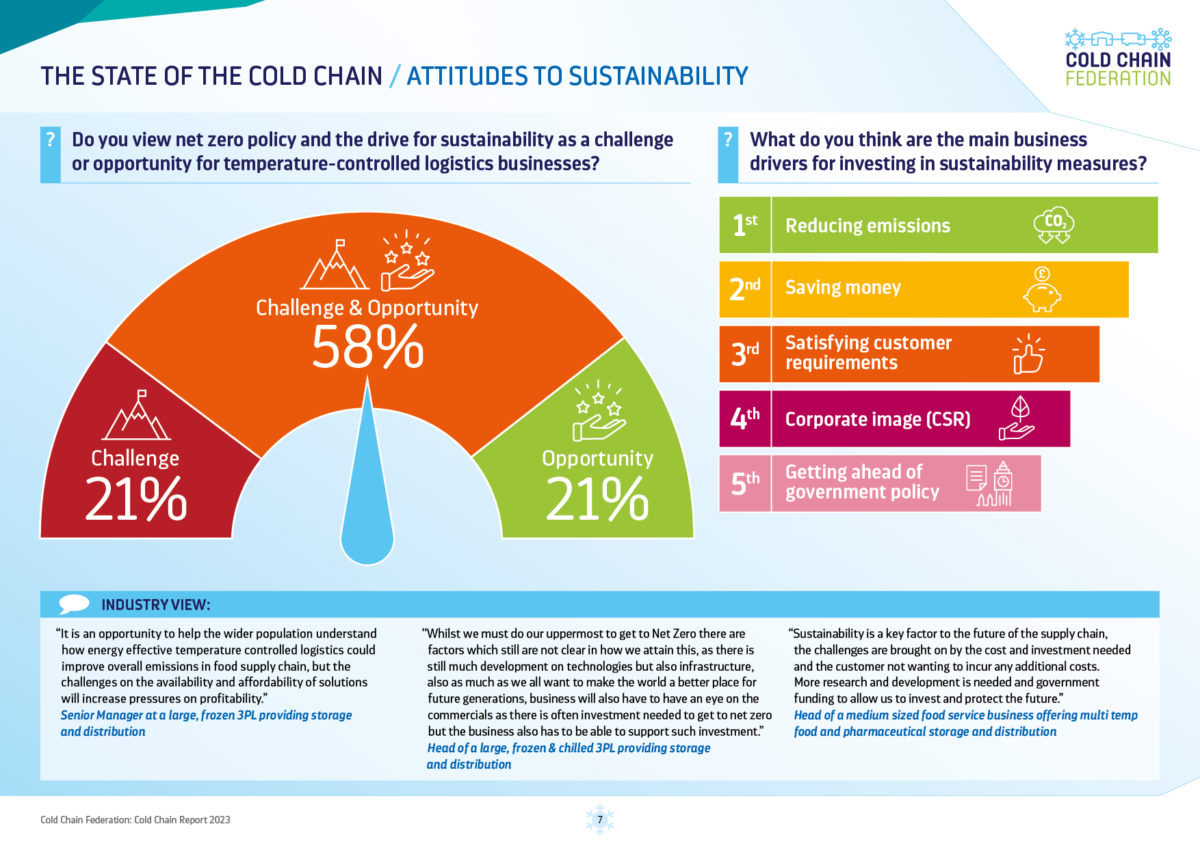

Cold chain professionals say energy management technologies will have more influence over temperature-controlled logistics in the coming decade than automation, blockchain or changes to demand for cold chain products.

The Cold Chain Federation’s new Cold Chain Report 2023, published today, includes the results of the federation’s State of the Cold Chain survey of more than 100 individuals from across the UK cold chain. The respondents chose energy management technologies as the greatest influence on how temperature-controlled logistics will operate in the next decade, with automation following in second place.

“The strong view among cold chain leaders that energy management technologies will have the greatest influence over the cold chain over the coming decade reflects not only the expectation that energy costs will remain high, but also the need to move towards net zero cold chain operations. Whether it be electrification of refrigerated vehicles, harnessing the power of renewables or thinking differently about energy storage and reusing the heat from our warehouses, the opportunities to save costs while meeting customer requirements and increasingly stringent regulations, are becoming the imperative. Our new data also shows how proactively operators are responding: 25% of UK cold storage sites are now fitted with renewable energy technology.”

The new Cold Chain Report 2023 also shows that although the cost of energy and other fuels is seen as the top current challenge for cold chain businesses, there are strong opportunities too such as increasing efficiencies and the growing demand for sustainable cold chain logistics. Overall, 91% of respondents described themselves as very positive or quite positive about the long-term future of the temperature-controlled logistics industry in the UK.

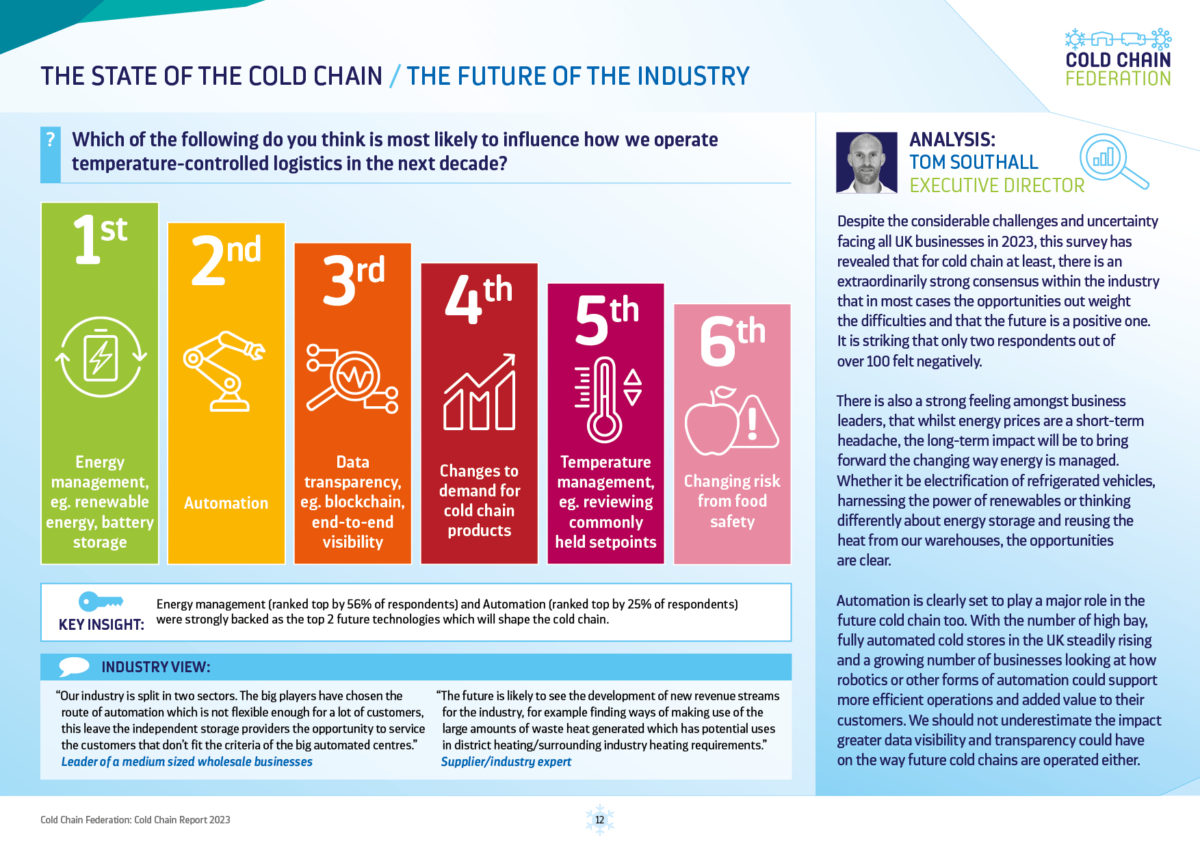

As well as detailing the findings of the State of the Cold Chain survey, the Cold Chain Report includes the federation’s analysis of the industry’s latest key facts and figures, including both cold storage and temperature-controlled distribution.

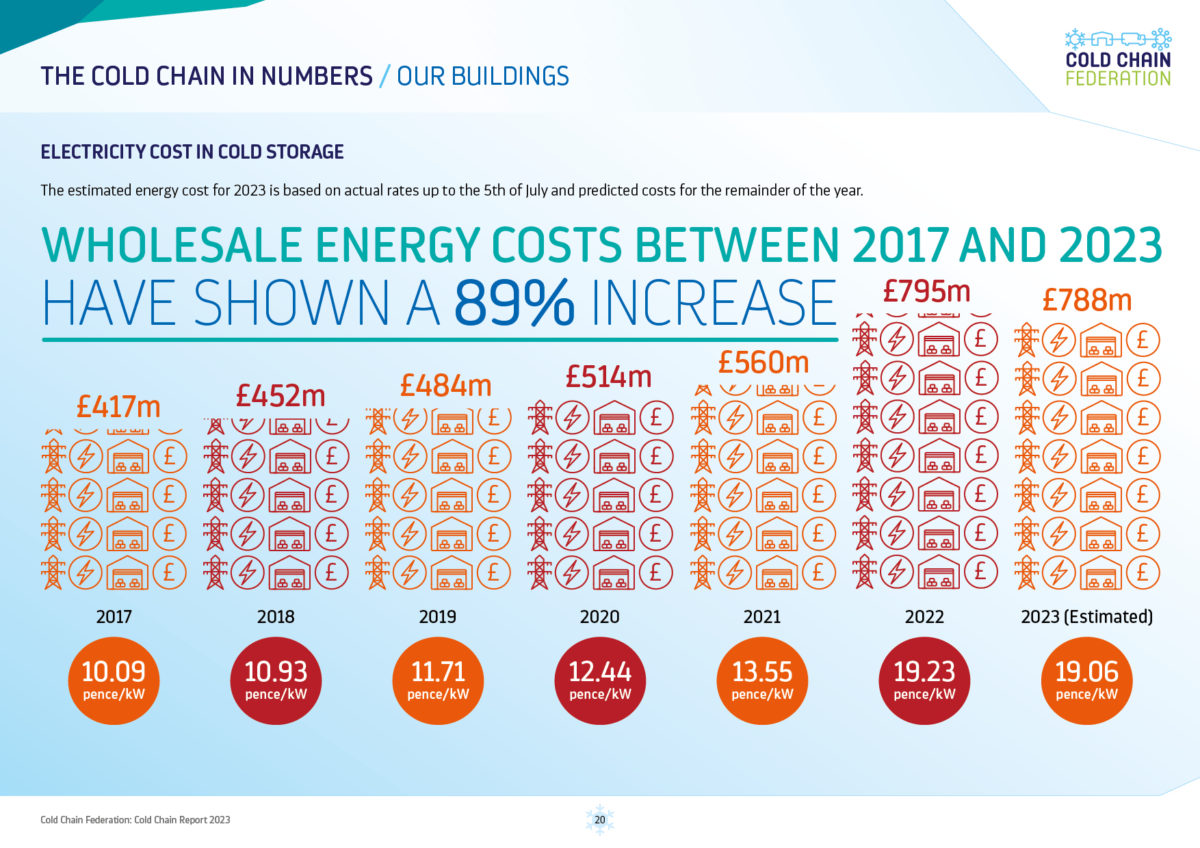

“Our new analysis shows that while wholesale energy costs are down slightly from 2022, this still represents an 89% increase in wholesale energy costs for the cold chain between 2017 and 2023. The report also shows just how extreme the impact of ending red diesel has been for temperature-controlled transport: in 2023 there is £73m in extra cost of fuel duty, following the end of red diesel entitlement in 2022. The duty increases the cost of diesel in UK transport refrigeration from £153m to £226m.”

Cold Chain Federation Executive Director Tom Southall

Other key findings from the State of the Cold Chain survey and the data analysis in the new report include:

- 68% of respondents felt driving efficiencies to reduce costs was one of the top opportunities for cold chain businesses. 62% said the growing demand for sustainable cold chain logistics services was one of the top opportunities for cold chain businesses.

- 79% of respondents cited the cost of energy and other fuel as a top challenge for cold chain businesses. Other challenges included labour costs, labour availability, sustainability requirements and UK economic uncertainty.

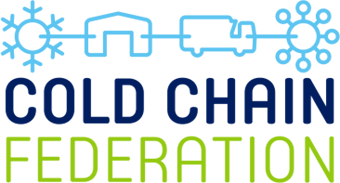

- 58% see net zero as both a challenge and an opportunity (21% view it as just an opportunity, 21% as just a challenge).

- Respondents chose investing in new, low carbon equipment as the most important action a temperature-controlled logistics business can take to reduce their carbon emissions. Second were improving the efficiency of existing equipment and reducing / eliminating the use if high GWP refrigerants.

- Respondents chose maintaining high service and levels of reliability as the top priority for their customers over the 12 months ahead. Reducing cost was chosen as the second priority.

- CCF membership has grown from 133 members in January 2019, to 278 members in June 2023. Attendance at CCF events (online and in person) has grown from 504 in 2019, to 1490 in 2022.

The full Cold Chain Report 2023 can be found here

Comments are closed.